2. Resources

2.1 All Resources

GoVenture includes all of the resources described below. The program is modular to give instructors the flexibility to choose the best resources that match your needs.

| Resource | Description | Time Required |

|---|---|---|

Tutorial Video Tutorial Video |

A detailed tutorial video is available that describes all of the resources below and how they can best be used. This video is for both teachers and students. Watch Tutorial Video |

50 minutes |

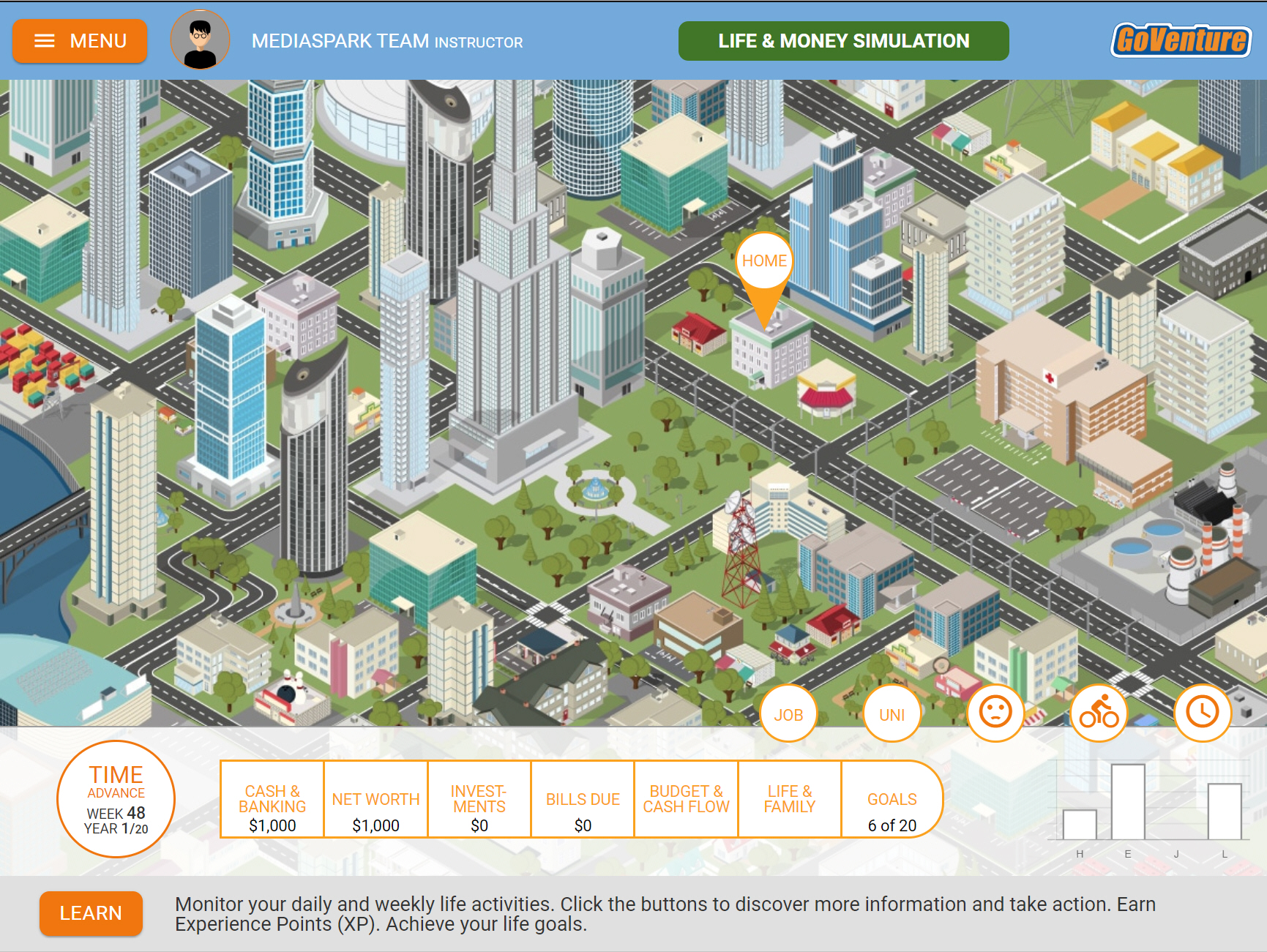

Life & Money Simulation Life & Money Simulation |

A highly interactive simulation game that enables students to directly experience personal financial literacy and investing by living their lives for up to 20 years. Play Life & Money Simulation |

Can be played for a few hours or dozens of hours. Multiple simulations with different objectives can be played at the same time. |

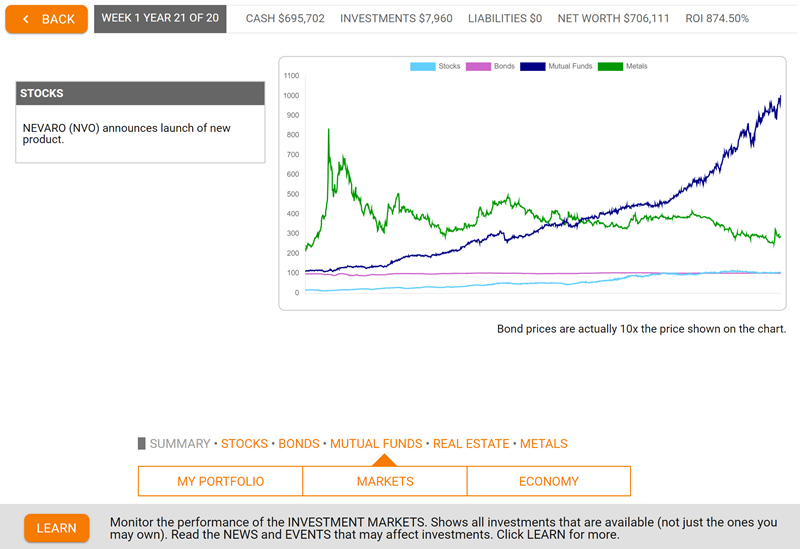

Investing Simulation Investing Simulation |

A simulation game that provides students with virtual money to invest in stocks, bonds, mutual funds, real estate, and gold. May be included within the Life & Money Simulation or run as an investing-only simulation |

Can be played for a few hours or dozens of hours. Multiple simulations with different objectives can be played at the same time. |

Learning Guide Learning Guide |

A comprehensive online guide with text, examples, and figures that explain all the fundamental topics of personal financial literacy and investing. The Learning Guide can be viewed at any time by students and instructors. Direct links to specific topics are also included at the bottom of every screen in the Simulation, making it easy for students to find support information while they play the Simulation. View Learning Guide |

Contains over 70,000 words (equivalent to a 300-page book) and provides comprehensive coverage to support a full curriculum. |

Your Story Simulation Your Story Simulation |

An engaging text-only story-based simulation. The ideal first activity to introduce students to basic financial literacy concepts. Play YOUR STORY Simulation | Requires 1.5 to 2 hours to complete. Automatically saves and resumes progress so that it can be played over multiple short sessions. |

eWorkbook eWorkbook |

An online workbook that introduces students to the basics of life and money. Content is presented in an easy-to-read summary format, supported with brief practice exercises at the end of each section (which must be completed correctly to continue). Ideal activity to start student learning (after or instead of the Your Story Simulation). Play the eWorkbook |

Requires 2 to 5 hours to complete. Automatically saves and resumes progress so that it can be played over multiple short sessions. |

Activities ONLINE Activities ONLINE |

Activities that allow students to learn and practice important financial concepts. These activities must be turned ON by the instructor. Once ON, students can play the Activities by logging in to GoVenture. Instructors can view student input using the Instructor Dashboard. See section 2.2 below for more details. | 10 Activities. Each Activity requires 15 to 60 minutes to complete. |

Activities PDF Activities PDF |

Printable Adobe PDF exercises that support the content in the Learning Guide. PDF Activities are available at the bottom of each section in the Learning Guide. See section 2.3 below for more details. | Over 70 Activities. Each Activity requires 15 to 60 minutes to complete. |

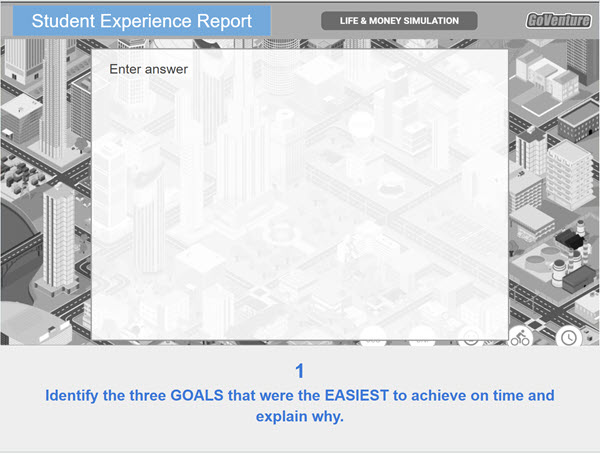

Student Experience Report or Presentation Student Experience Report or Presentation |

Students prepare written, live, or video presentations or reports on their experience playing the simulation and achieving their life goals. View Template |

|

Videos Videos |

Videos to enhance student learning – curated from around the world. Hundreds are available. View Videos |

Most videos are a few minutes in duration. |

Tutorials Tutorials |

Video Tutorials for playing the simulation. The Simulation also includes an in-game tutorial. View Tutorial |

50 minutes |

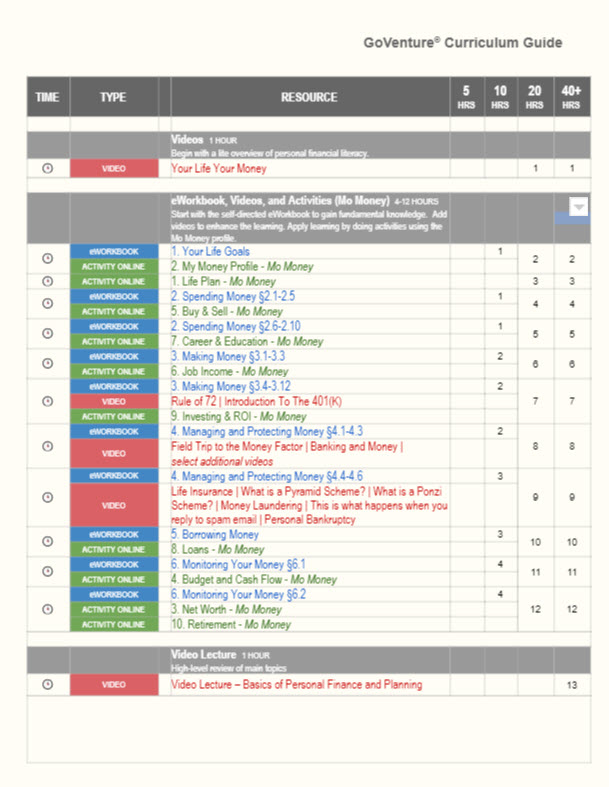

Curriculum Planning Guide Curriculum Planning Guide |

Helps instructors with course planning. The duration and sequence of GoVenture resources are presented with options for matching 5, 10, 20, 40+, and 110+ hours of curriculum time. See section 6 of this document. |

|

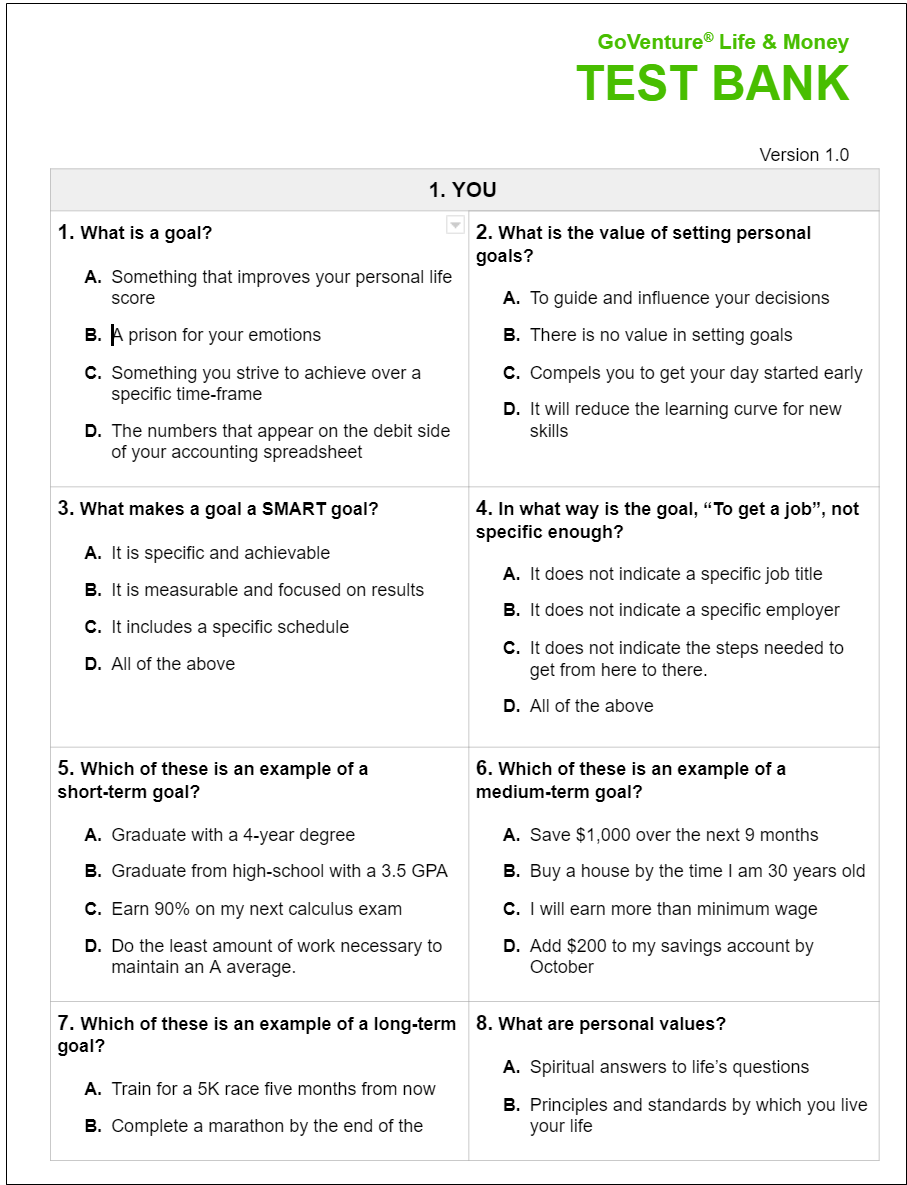

Test Bank Test Bank |

Over 300 multiple-choice questions aligned with the main sections of the Learning Guide. The quiz is available in a document where you can copy and paste questions to build your own printable test. Contact us to request the Test Bank. | |

| Develop Language Skills | A document that describes how GoVenture can be used to develop student language skills. | View Document PDF |

| Accessibility for People with Disabilities | The student resources listed in this table may be accessible to students with disabilities, depending on the type and degree of disability. | See section 8 of this document |

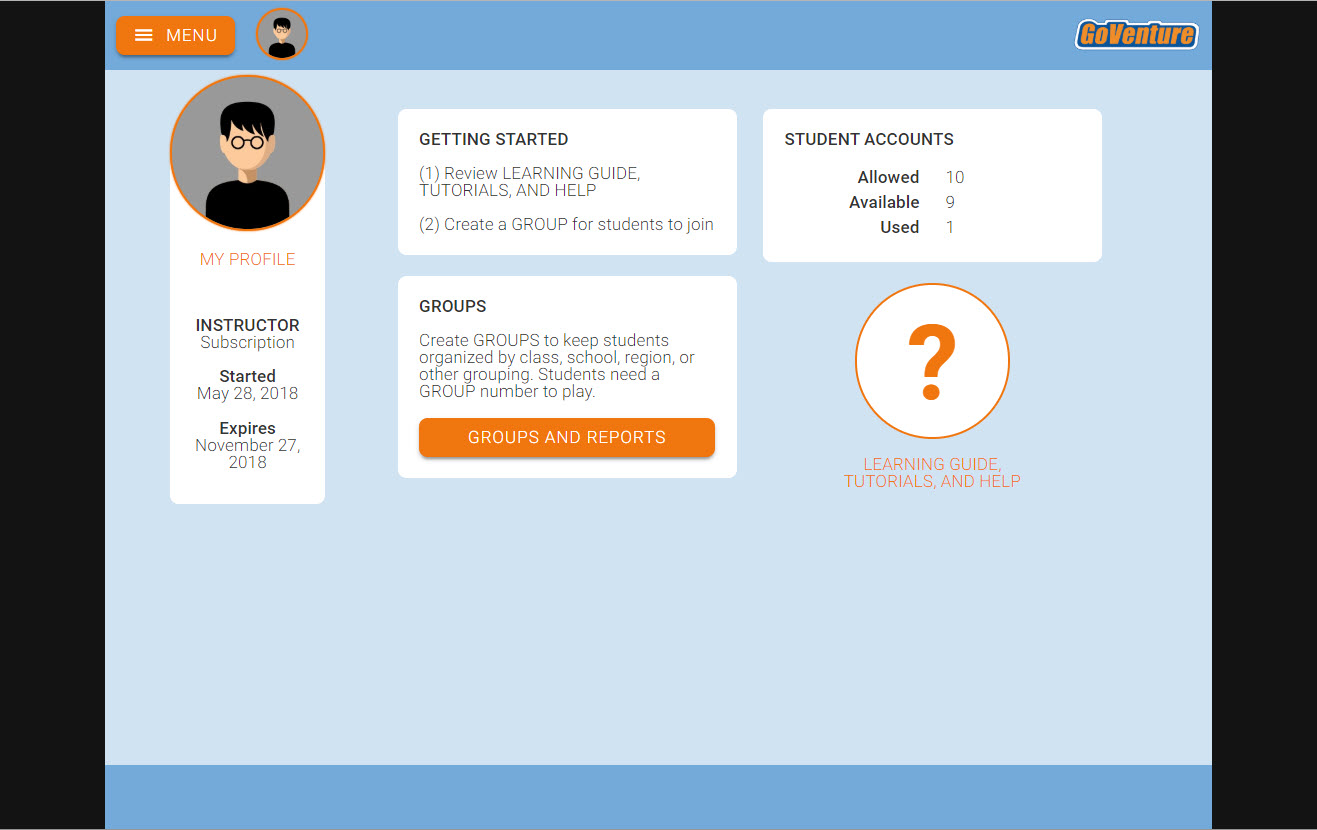

Instructor Dashboard (Website) Instructor Dashboard (Website) |

A website that enables instructors to manage GoVenture and their students. | Students and instructors log in to the same GoVenture website. Instructor accounts are encoded with additional privileges to provide access to a special dashboard. |

2.2 Online Activities

There are 10 ONLINE Activities that allow students to learn and practice important financial concepts.

Each Activity takes 15 to 60 minutes to complete.

These activities must be turned ON by the instructor by creating a Group (or changing Group settings). Once ON, students can play the Activities by logging in to GoVenture.

Instructors can view student input using the Instructor Dashboard.

Information on how to play each Activity is available to students by clicking the LEARN button in each Activity — the LEARN button links to this webpage

Instructors can have students play the ONLINE Activities using one of three profiles —

MO's PROFILE

Mo is a fictional character with a detailed profile that can be used as a context to play all of the activities. It is recommended that students play the activities first using Mo's profile. Directions for completing an activity using Mo's profile are included at the bottom of each activity description/help. Answers for instructors are included in the table below. Read Mo's profileSTUDENT PERSONAL PROFILES

Instructors can encourage students to research the information they need to make the data more personally relevant.PROFILES PROVIDED BY THE INSTRUCTOR

Instructors can use custom profiles to guide students to discover key information that matches the curriculum.

The tables below provide a summary list of each ONLINE Activity.

Each activity is numbered for easy reference.

See the Assessment section of this document for language skill development and grading rubrics.

| ONLINE ACTIVITY | DESCRIPTION |

|---|---|

| About Online Activities | Completed Activities with Mo's Profile for Instructors (PDF) You must be logged in as an instructor to view this document. |

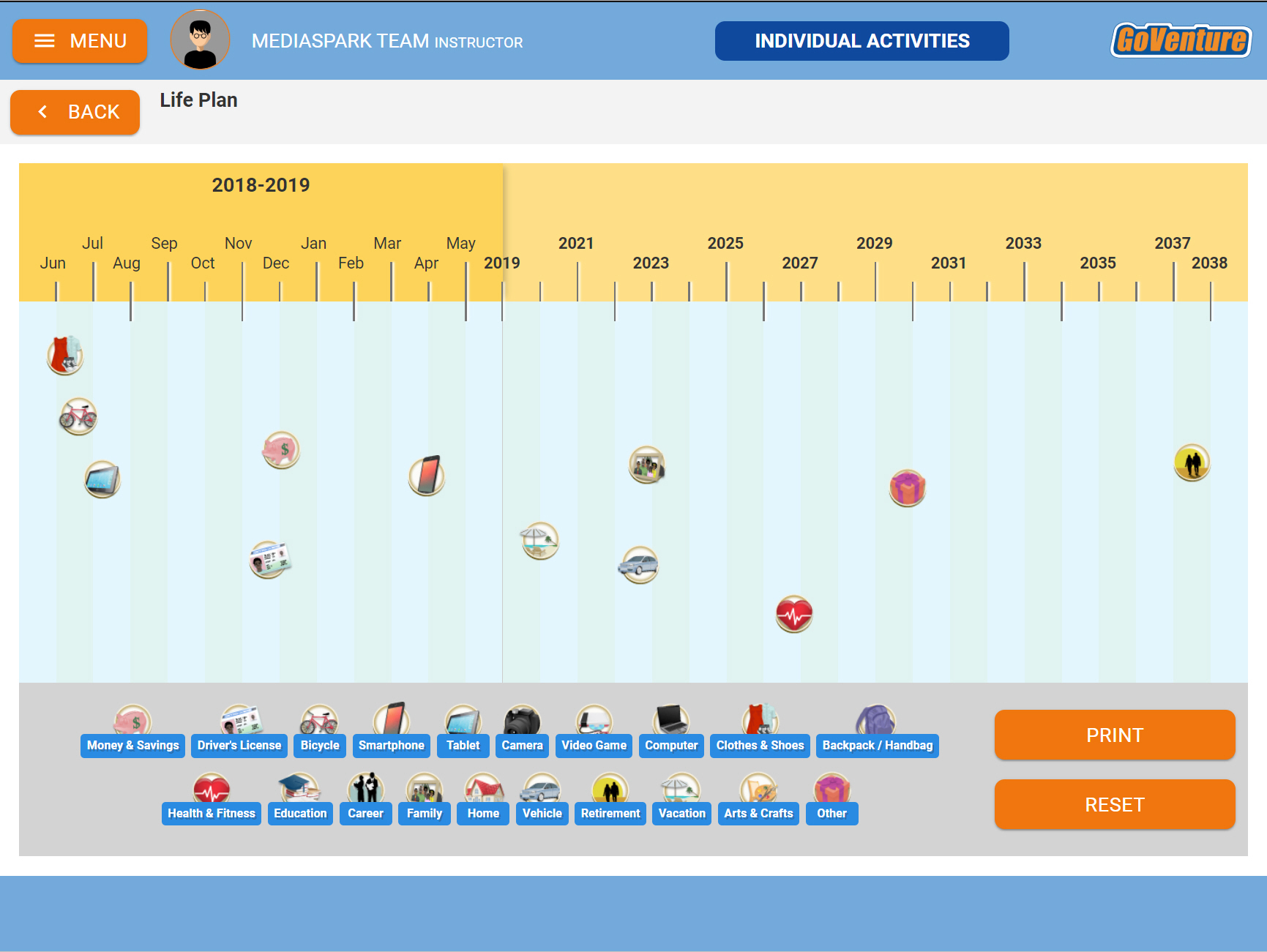

| 1. Life Plan | Build your short-term and long-term life plan by adding goals to a visual calendar. |

| 2. My Money Profile | Consider the type of lifestyle you want to have and how comfortable you are with taking financial risks to achieve your goals. |

| 3. Net Worth | Build a Net Worth statement - an indicator of your personal wealth. |

| 4. Budget & Cash Flow | Add up all the money you receive each month and subtract all the money you pay out. |

| 5. Buy & Sell | Discover the cost of common products and how they may lose monetary value over time. |

| 6. Job Income | Determine how much money you can earn with a job, minus employment deductions and taxes. |

| 7. Career & Education | Determine the financial benefits and costs of education for a specific job. |

| 8. Loans | Calculate various loan options. |

| 9. Investment & ROI | Calculate the Return On Investment (ROI) of various investment options. |

| 10. Retirement | Determine how much money you may need when you retire. |

2.3 PDF Activities

There are over 70 PDF Activities — printable Adobe PDF exercises that support the content in the Learning Guide. PDF Activities are available at the bottom of each section of the Learning Guide.

Each Activity takes 15 to 60 minutes to complete.

Activities and answers for instructors are available in the table below.

Activity identifiers use the following coding:

- The first 2 digits match the section/chapter in the Learning Guide

- D = Define Key Terms

- L = Listen & Speak

- R = Read & Write

- K = Knowledge Test

| LEARNING GUIDE SECTION | PDF ACTIVITY |

|---|---|

| PDF Activities for students are available at the bottom of each section of the Learning Guide. | Completed Activities (Answer Key) for Instructors (Adobe PDF) You must be logged in as an instructor to view this document. |

| 1. You | 01D1 Define Key Terms | You 01K1 Knowledge Test | Setting Goals 01K2 Knowledge Test | Needs and Wants |

| 2. Your Personal Finances | 02D1 Define Key Terms | Your Personal Finances 02L1 Listen & Speak | Your Personal Finances 02R1 Read & Write | Compensation from Employment 02K1 Knowledge Test | Net Worth 02K2 Knowledge Test | Cash Flow & Income |

| 3. Your Assets | 03D1 Define Key Terms | Assets 03L1 Listen & Speak | Assets |

| 4. Your Liabilities | 04D1 Define Key Terms | Liabilities 04L1 Listen & Speak | Liabilities 04R1 Read & Write | Liabilities |

| 5. Your Lifestyle | 05D1 Define Key Terms | Your Lifestyle 05K1 Knowledge Test | Own vs Rent a Home 05K2 Knowledge Test | Own vs Lease a Car |

| 6. Managing Your Assets and Liabilities | 06D1 Define Key Terms | Managing Your Assets and Liabilities 06L1 Listen & Speak | Managing Your Assets and Liabilities 06R1 Read & Write | Managing Your Assets and Liabilities 06R2 Read & Write | Estate Planning Tools 06R3 Read & Write | Impact of Unplanned Spending 06K1 Knowledge Test | Charitable Giving 06K2 Knowledge Test | The Financial System 06K3 Knowledge Test | Retirement 06K4 Knowledge Test | Budget 06K5 Knowledge Test | Cash Management Tools |

| 7. Key Investment Concepts | 07D1 Define Key Terms | Key Investment Concepts 07L1 Listen & Speak | Key Investment Concepts 07R1 Read & Write | Key Investment Concepts |

| 8. Making Your Money Grow | 08D1 Define Key Terms | Making Your Money Grow 08L1 Listen & Speak | Making Your Money Grow 08R1 Read & Write | Making Your Money Grow |

| 9. The Investment Timetable | 09D1 Define Key Terms | The Investment Timetable 09L1 Listen & Speak | The Investment Timetable 09R1 Read & Write | The Investment Timetable |

| 10. Calculating the ROI | 10D1 Define Key Terms | Calculating the ROI 10L1 Listen & Speak | Calculating the ROI 10R1 Read & Write | Calculating the ROI |

| 11. Banking | 11D1 Define Key Terms | Banking 11L1 Listen & Speak | Banking 11R1 Read & Write | Evaluate Savings Options 11K1 Knowledge Test | Reconcile Bank Statement 11K2 Knowledge Test | Write Checks 11K3 Knowledge Test | Debit and Credit Cards |

| 12. Money Market Instruments | 12D1 Define Key Terms | Money Market Instruments |

| 13. Bonds | 13D1 Define Key Terms | Bonds 13L1 Listen & Speak | Bonds |

| 14. Stocks | 14D1 Define Key Terms | Stocks 14L1 Listen & Speak | Stocks |

| 15. Mutual Funds | 15D1 Define Key Terms | Mutual Funds 15L1 Listen & Speak | Mutual Funds |

| 16. Other Equity Investments | 16D1 Define Key Terms | Other Equity Investments |

| 17. Annuities and Types of Life Insurance as Investments | 17D1 Define Key Terms | Annuities and Types of Life Insurance as Investments |

| 18. Insuring and Protecting | 18D1 Define Key Terms | Insuring and Protecting 18R1 Read & Write | Apply Risk Management Strategies 18K1 Knowledge Test | Consumer Protection 18K2 Knowledge Test | Automobile Insurance 18K3 Knowledge Test | Types, Benefits, Costs of Insurance |

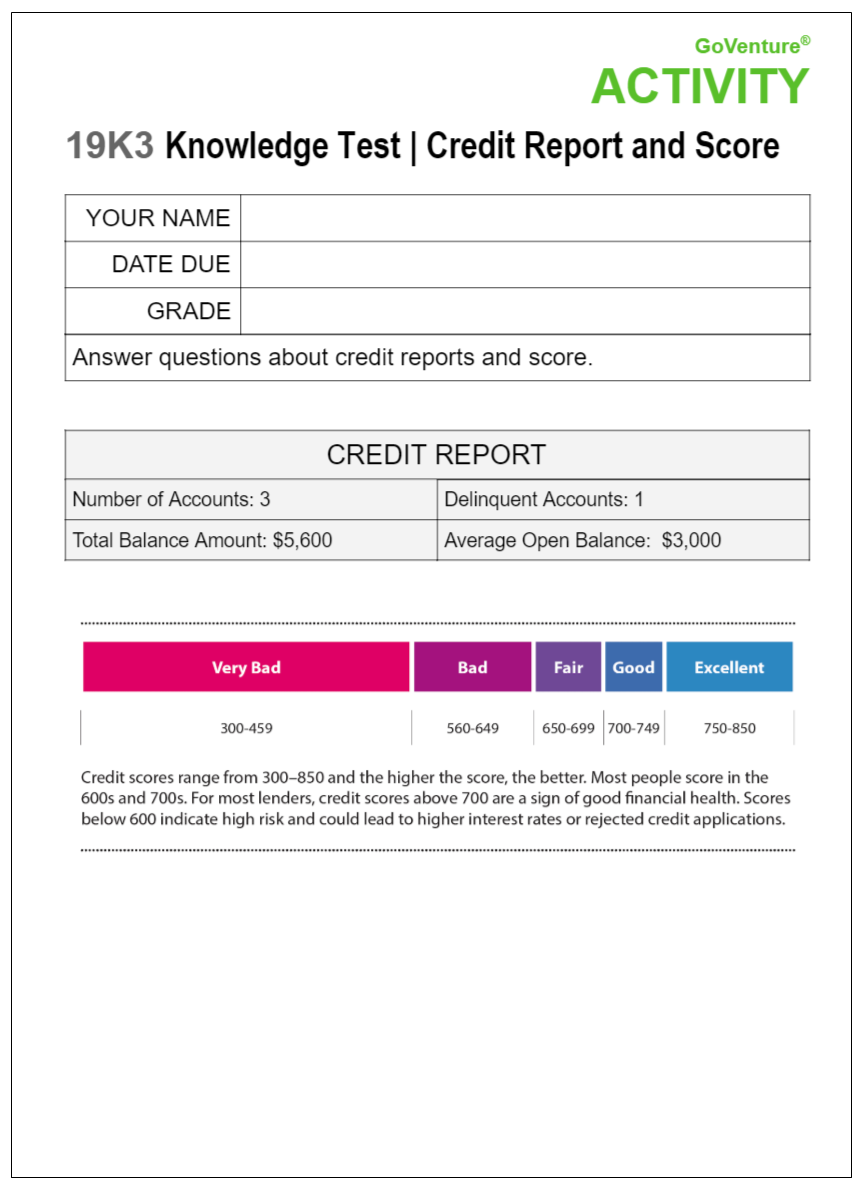

| 19. Credit and Borrowing | 19D1 Define Key Terms | Credit and Borrowing 19L1 Listen & Speak | Bankruptcy 19R1 Read & Write | Costs of Borrowing 19K1 Knowledge Test | Credit Worthiness 19K2 Knowledge Test | Credit Decisions 19K3 Knowledge Test | Credit Report and Score 19K4 Knowledge Test | Alternative Methods of Payment |

| 20. Education and Training | 20D1 Define Key Terms | Education and Training 20K1 Knowledge Test | Paying for a Postsecondary Education 20K2 Knowledge Test | Comparing the Costs of Education |

| 21. Taxes | 21D1 Define Key Terms | Taxes |

| 22. Managing a Paycheck and Taxes | 22D1 Define Key Terms | Managing a Paycheck and Taxes 22K1 Knowledge Test | Analysing a Pay Stub |

| 23. Playing the Simulation |